Cash flow forecasting is a bit like crystal ball gazing – except perhaps a little more informed!

By getting an idea of when your business will have money coming in and going out, you can plan for the future, predict peaks and troughs and avoid financial issues that could otherwise harm your business.

TL; DR

A cash flow template helps to standardise forecasting and makes comparing different periods much easier. Cash flow forecasting is important for identifying periods of positive and negative cash flow in advance and making informed decisions accordingly.

Understanding cash flow forecast

A cash flow forecast is a projection of how cash will flow through your business in a period of time. Cash flow projections include income and outgoings, all the while monitoring how it impacts the money you have on hand. This is why you need a cash flow forecast – you need to know if you have the cash on hand when needed to stay in business and to take upcoming oppourtunities.

Forecasted cash flow statements can be done manually in a spreadsheet, but often these days are compiled in a business’ online accounting or invoicing software.

Forecasts include projections for:

- The period’s starting bank balance

- Income

- Outgoings, including expenses, investments, debt repayments etc.

- Ending bank balance

Carrying out a cash flow forecast is one of the best tips for positive cash flow in your business.

How can a cash flow forecast help your business?

By identifying periods of cash surpluses or shortages, you can make more informed decisions about how to grow your business and manage your money.

Cash flow projection example:

You want to buy an expensive piece of equipment for your business that will help to increase your production capacity. A cash flow analysis project can identify a period where you expect to have surplus cash and can afford to buy the equipment and still have cash left over to pay bills and overheads.

Without a cash flow forecast, you might go out and buy the equipment and find out later you don’t have the money on hand to pay suppliers or staff in a month’s time.

A cash flow forecast is also useful to identify upcoming slow periods of business where you may need to take out a loan to get you through to when things pick back up again. Being prepared for business slumps gives you a much better chance of negotiating these inevitable times.

Read more: Understanding cash flow lending

A cash flow forecast is also a great thing to take to a lender if you need to take out a loan. It shows them you understand your finances, are able to make repayments (hopefully!) and are prepared for the future.

Tips to build a forecasted cash flow

So how do you actually build a business cash flow forecast? By looking at business cycles and variations from one period to the next, cash flow tracking can actually be quite accurate.

It pays to prepare both best case and worst case scenarios to understand the breadth of possible variations in reality, as well as a most likely estimate. This will help to give a fuller understanding of how things may go, and if you need to look at ways to improve cash flow in a given period.

Predict income from sources

Income isn’t just cash from sales, it includes any cash injection. Look at projects that are in the pipeline and make a judgement on how much money you could make in the period you’re looking at.

You can also base it off what you’ve earned in the past. For a new business, it pays to speak to an accountant or someone with experience in your industry.

Estimate outgoings

Include as many expenses and outgoings as you can for the most accurate cash flow forecast. Past utility bills and wage payments will help. The more detail you include, the better.

Look at sales cycles or other seasonal variations

Don’t just take sales figures from last month – if you can, take data from the same month last year. Many businesses are seasonal, and don’t grow in a linear pattern.

Understand how your business tends to perform in a given season and apply your growth rate or performance expectations from there.

Read more: How to overcome common barriers to cash flow

Check your capacity

Do you actually have the resources on hand to generate the sales you’ve predicted? Staff on leave, fluctuating staffing levels and resource availability can all influence your capacity, and therefore income.

Look for benchmarks

Find similar examples of businesses in your industry, and see how your forecast compares. If there’s a significant difference between your projections and an industry benchmark, ask yourself why – you can guarantee anyone assessing your forecast (like the bank) will want to know!

Involve your accountant

Getting a professional to go over your forecast is a great way to ensure you haven’t made any obvious mistakes. They can standardise your forecast to industry standards and provide tips to guide your business cash flow management.

What is a cash flow forecast template?

There’s an inherent risk in setting expectations for the future based on potentially unreliable estimates, but a template reduces the variables and allows for projections to be more comparable from one period to the next.

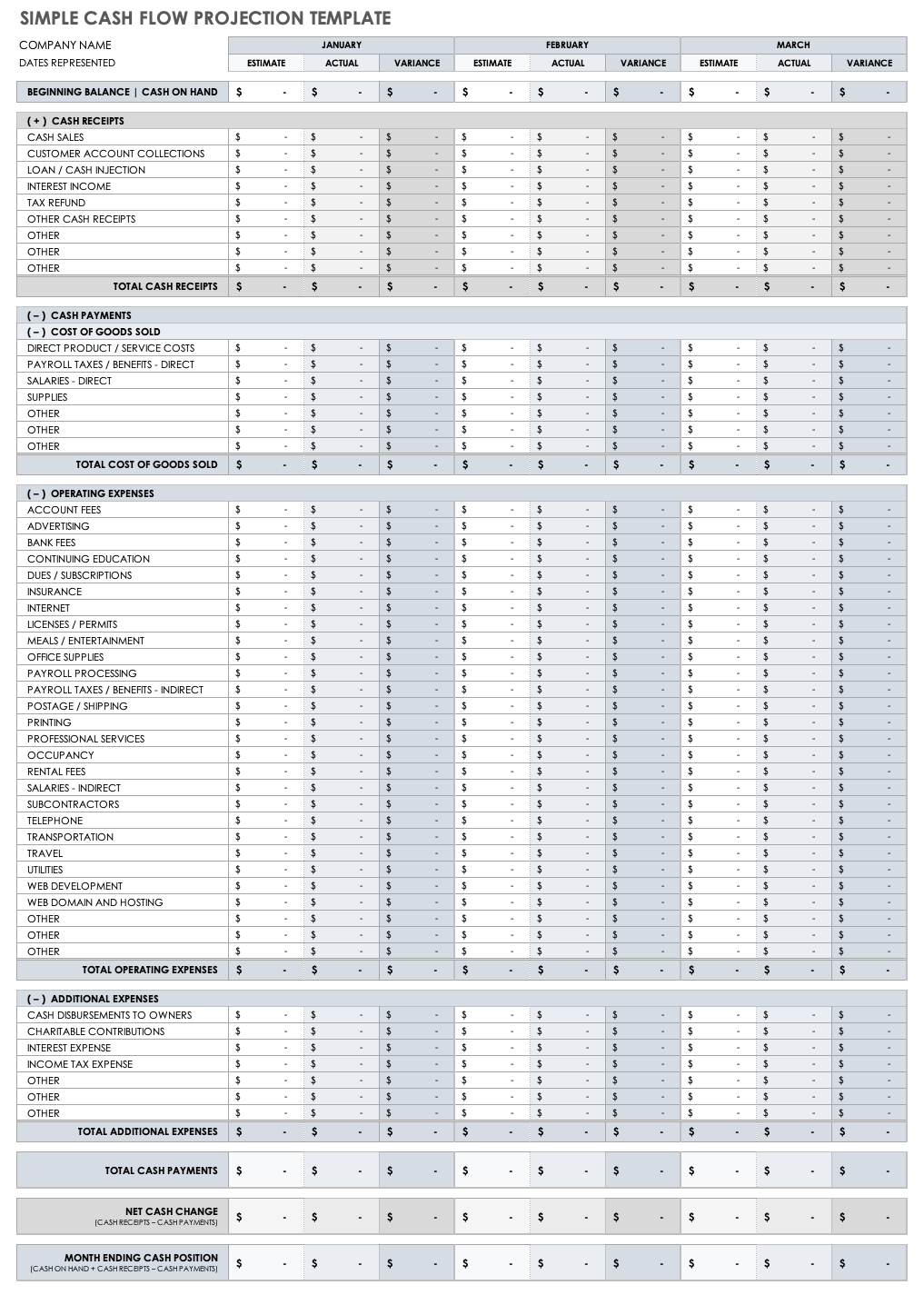

A cash flow forecasting template comes with pre-set criteria to take the guesswork out of projecting your numbers. It often comes in the form of an Excel spreadsheet.

Read more: Overcome cash flow challenges in the construction industry through forecasting

By using a template, you have a reliable outline of possible income and outgoings to ensure you don’t miss anything or make any calculation errors. All you need to do is enter projections.

How to create your own cash flow forecast template?

There are lots of cash flow forecast templates available online (including one below), but you can also create your own if you like.

This has the advantage of not leaving blank categories where fields don’t apply to you, which makes your projections more readable and easier to comprehend. If you like, you can base your template off another one, or you can start from scratch.

Either way, first open an Excel spreadsheet.

Step 1: Create columns for each of the periods you want to forecast for. It’s recommended you do this monthly.

Step 2: List all the different types of income (at the top) and outgoings (below this) in your business down the left hand side. Categorise each item as much as you need to get an accuarate idea of what to expect in the future, including different types of sales and breakdowns for different premises if you have multiple sites.

Step 3: Enter your recurring income or outgoings that you already know about. For example, things like rent or loan repayments that are a fixed price. Many businesses won’t have predictable income, so this is likely to just apply to a few different outgoings.

Step 4: Forecast your unknown income and outgoings. Take your time to make accurate projections, and remember to include best case, worst case and most likely scenarios.

Simple cash flow forecast template

Take home message

Cash flow tracking is one of the best ways to identify and navigate cash flow barriers in your business.

82% of businesses that fail cite cash flow issues as a reason why, so it’s worth taking the time to understand your cash flow and plan to deal with any issues before they occur.

When you see periods of negative cash flow coming, invoice financing with FundTap is an excellent tool to help with business cash flow management. It’s a form of lending that has been designed specifically for small business owners that is easy to get, flexible and affordable.

Find out more about how FundTap works today.

Related News

Check out related articles & resources.