Looking For A  Alternative?

Alternative?

Get On Demand Finance With FundTap

Why do our customers love FundTap?

Get started

in minutes

With integrations to the top accounting software – it takes minutes to get going.

The fastest access to funds

It’s the fastest source of finance – paid into your bank account in hours.

No changing bank accounts

No change to how you invoice or collect payments. Your customers won’t know.

How does it compare?

| Waddle - Online Invoice Finance | ||

|---|---|---|

| Easy to establish | ||

| Online and mobile | ||

| Link to Accounting System | ||

| Application approval | 1 hour | 48 hours + |

| Quick funding | Minutes | Days |

| No Establishment fees | ||

| No Admin or System fees | ||

| Debtor pays to normal account | ||

| Use only when needed, without penalty |

Our trusted partners

Check out our integrations with our accounting partners.

Do I qualify?

54% – The average growth in revenue for FundTap customers over the last 2 years.

How much can I borrow?

You can get $0 in your bank account in hours.

When your customer pays your invoice of $200, we then direct debit your account for the advance of $180 and the fee – in this case, $43.

We know for many businesses, their customers do not pay on time. 2 days before we direct debit your account, we send an email reminder. You can then change this direct debit date if needed.

You’re in good company

Don’t just take our word for it, have a read why we’re our customers’ preferred invoice finance provider and why they choose to keep coming back for our simple solution for their cash flow needs.

.webp?width=210&height=210&name=sarah-210x210%20(1).webp)

Sarah H

YUM Foods

“We love the convenience and accessibility of FundTap. It’s simple which is really nice and has enabled us to do things we wouldn’t otherwise.”

.webp?width=210&height=210&name=Graffic-G-Logo-Gray-210x210%20(1).webp)

Matt E

Graffic

“FundTap gives me added control over this and is incredibly efficient and easy to use. Highly recommended!”

.webp?width=210&height=210&name=android-touch-transformed-210x210%20(1).webp)

Craig M

CLM Group

“FundTap have provided a unique and professional service in unlocking the funds tied up in jobs already completed. FundTap allows me to pursue other higher margin work by providing me with funds quickly. They have always been truthful in their advice and will always make the recommendation on financing invoices that is within your best interest not their own. Can’t recommend these guys highly enough! An absolute must partner for any small trade business.”

.jpg?width=210&height=210&name=120336884_2830991830469301_7988199706671199866_n-210x210%20(1).jpg)

Stuart W

Gralich Compliance Management

Excellent service. Easy to connect and get started, great communication from the team without being pushy.

.jpeg?width=210&height=210&name=image-7KYFkk0vH-transformed-210x210%20(1).jpeg)

Tinealle M

The Print Company

Jonelle and the team from FundTap provide my company with an excellent product and service. It’s reassuring to know that when I make the call they move quickly to help me. I highly recommend these guys if you’re looking for a financial support business partner that you can always rely on.

Gary M

NYA Cake Guys

“They took the time to understand our unique business requirements, without being pushy, great service.”

Greg C

Titanium Traffic Plans

A great, flexible and easy way to manage cashflow and regulate working capital! Fees are shown upfront so you know exactly what is happening, and the online portal is very well set out and easy to use. Highly recommend!

Glenn D

e3 Scientific

“Great service with a professional team. FundTap does a great job at plugging the gap for small businesses and providing confidence to make decisions regarding business growth.”

Frequently Asked Questions

FundTap increases your business’ short-term cash flow. Your outstanding invoices turn into immediate cash so you can grow and run your business, without being restricted by a shortage of cash.

FundTap is easy, quick and paperless. You do not need to spend your time collecting information for us. The sign-up process takes only 5-10 minutes. Subsequent funding is as quick as logging in and selecting the invoices. You can have funds in your account within hours so you can spend your valuable time growing and running your business.

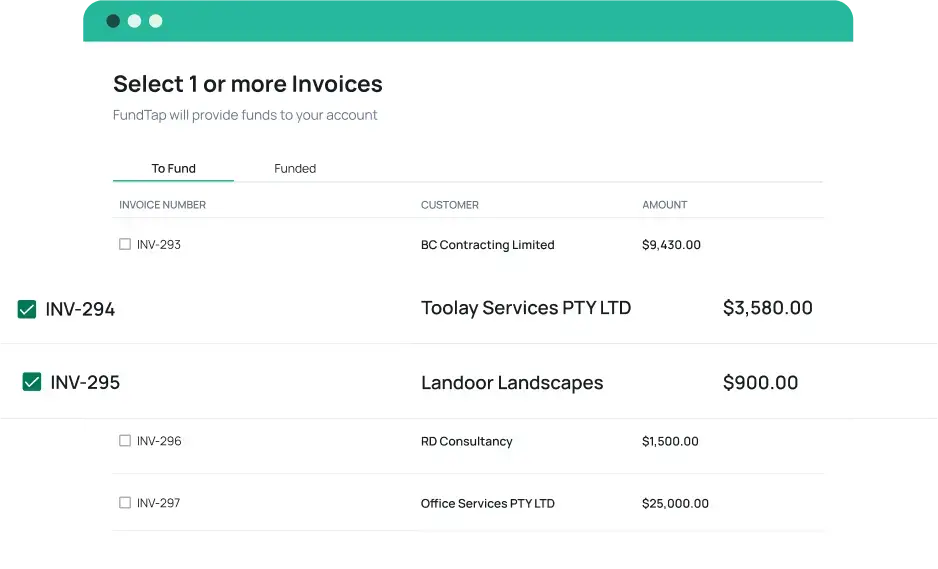

You create a free FundTap account and follow the prompts to seamlessly link your cloud accounting system. You will then see a list of your outstanding invoices. Now you can select the outstanding invoices you wish to have funded by FundTap.

The amount you will receive and the fees are displayed so you have all the information you need to make a decision. The funds are deposited into your account, usually within hours.

After the invoice due date, FundTap will direct debit your account for the amount advanced and the fee. Done! The simple way to manage cash flow.

No. Unlike other invoice finance providers, you do not need to change the bank account your customer will pay into. With other providers all of your nominated customers would need to pay into a trust account owned by the invoice financier. This causes a delay in you receiving payment. It also locks you into invoice financing as you need to change the account again should you then wish to not use invoice financing… and again when you need further finance…

FundTap keeps it simple. Your customers pay you as they do normally. We then direct debit your account when they pay you. You can use FundTap when you need, and not when you don’t. You are always in control.

We have built FundTap from the ground up to streamline the funding process for you. Once you have created a free FundTap account you will be directed to sync your invoices. Here you will be asked to provide authorisation to link your accounting system to FundTap by entering your user name and password. You’re done. It’s that simple.

Like other lenders, we need access to some of your financial information. Unlike other lenders, by accessing your accounting system, we save you from having to manually obtain and upload this information.

We need access to your financial information and the history of your debtors’ payments. We do not access any information on your employees, any details about your customers’ employees or any inventory information.

We are keenly aware of the trust placed in us.

We understand this can happen. It’s as simple as logging in and changing your direct debit date (and it will recalculate the fee). Or just let us know and we can reschedule the direct debit to follow your customer’s new payment date.

No problem. If you pay early there are no extra charges. In fact, we recalculate and reduce your fee to reflect the reduced time. To pay early, you can bring forward the direct debit date in your account. Or just get in contact with our team and we can manage it from there.

Factoring is similar to what FundTap does in that factoring is based on extracting funding from your invoices.

FundTap has many advantages over factoring companies. Factoring companies take over all of your debtors’ ledgers, lock you into an ongoing contract and charge you monthly administration fees.

FundTap allows you to choose exactly which individual invoices, and how many invoices you wish to sell, in order to fix your cash flow. The power is in your hands – we have no lock-in contracts and we don’t charge monthly administration fees.

Our fee starts as low as 4% of the invoice value. We don’t have any sign-up fees, administration fees, documentation fees, early repayment fees, monthly or annual fees. The only fee you pay is for the funding you receive. You are in control of the costs.

To ensure you can make the right funding decision, we show you the cost before you decide to go ahead. We have a handy funding and fee calculator on this page.

No. We buy your invoices and so we are not lending money. Because of this, your ability to borrow money from your bank or other lenders is not affected.

No. You have spent time carefully building relationships with your customers and we will in no way jeopardise this. Your customer does not know you are using FundTap to bring forward funding to secure your business cash flow.

.webp)